Some Known Details About Home Owners Insurance In Toccoa Ga

Table of ContentsThe Facts About Annuities In Toccoa Ga UncoveredThings about Life Insurance In Toccoa GaThe Best Guide To Commercial Insurance In Toccoa GaAutomobile Insurance In Toccoa Ga Things To Know Before You BuyAnnuities In Toccoa Ga for DummiesFinal Expense In Toccoa Ga Fundamentals Explained

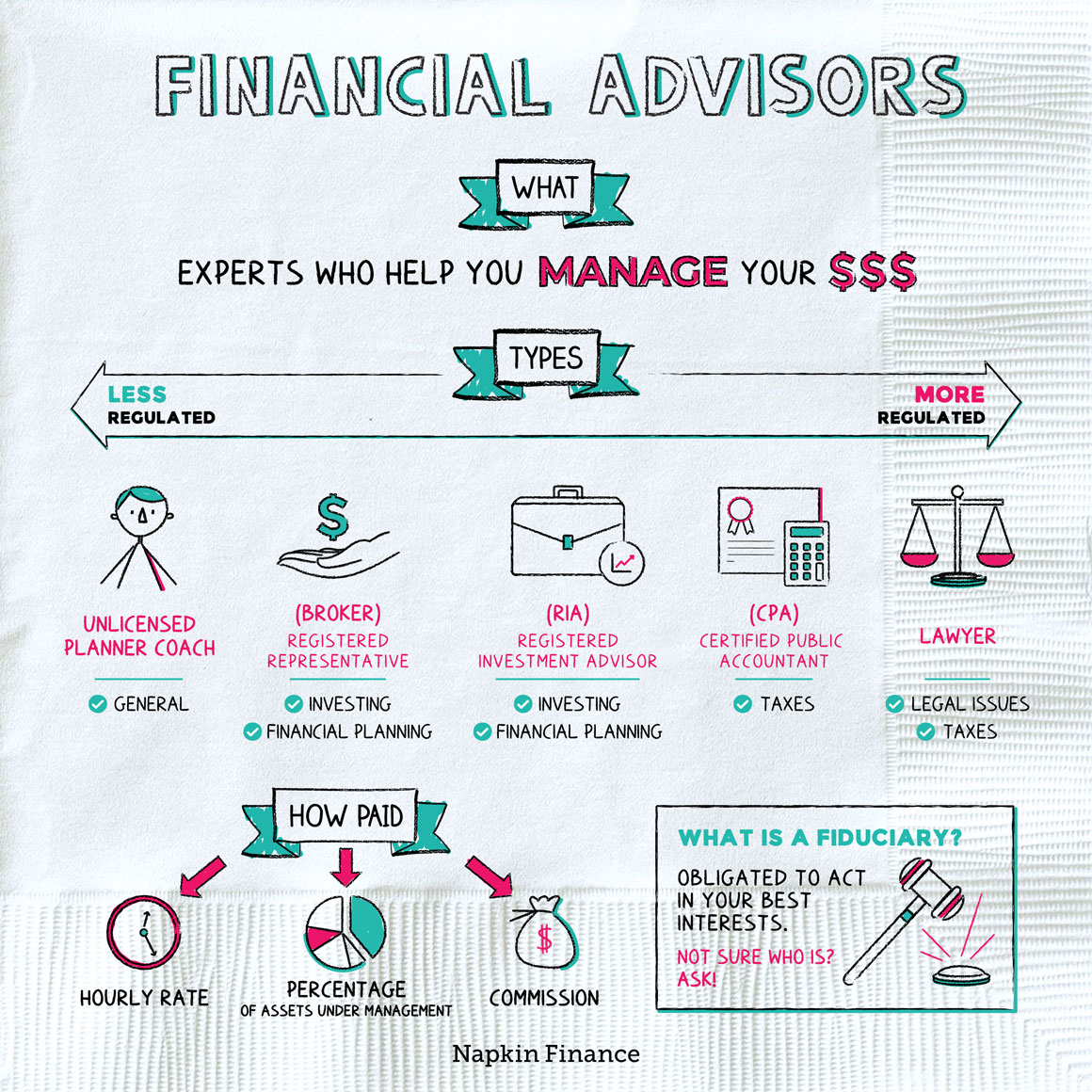

This could imply organizing an one-time session with a therapist to optimize your finances or it may suggest having a certified investment adviser on retainer to handle your possessions. Settlement frameworks differ relying on client demands and the solutions provided by the monetary consultant. A monetary expert may function for a company and consequently earn a salary, or they might make a per hour price independently.Here are 5 steps to help you choose an economic expert for you. Locate and employ fiduciaries, monetary advisors, and economic coordinators that will function with you to accomplish your wealth goals.

Before you start looking for the ideal expert, reflect on what you're really hoping to obtain out of that relationship - Final Expense in Toccoa, GA. Financial experts provide a broad variety of solutions, so it's a good idea to understand what you need aid with before you begin your search.

The smart Trick of Home Owners Insurance In Toccoa Ga That Nobody is Discussing

Determine why you're looking for economic help by asking the complying with inquiries: Do you need help with a budget? Would you like to develop an economic strategy? Your responses to these concerns will certainly help you locate the right kind of monetary expert for you.

, or CFP, designation have a fiduciary task to their customers as component of their certification (https://yoomark.com/content/thomas-insurance-advisors-located-toccoa-ga-and-toccoas-leading-insurance-agency-serving).

Nerd out on spending information, Subscribe to our monthly investing e-newsletter for our nerdy take on the supply market. Financial experts have an online reputation for being expensive, yet there is a choice for every budget plan.

The Main Principles Of Final Expense In Toccoa Ga

Just how much you must spend on a financial advisor depends on your budget, assets and the level of economic guidance you need. If you have a tiny portfolio, an in-person advisor may be overkill you will certainly save cash and obtain the advice you require from a robo-advisor. If you have a complicated financial scenario, a robo-advisor might not offer what you require.

25% of your account balance per year, traditional in-person consultants typically cost around 1% and online economic planning services often tend to fall somewhere in between. That can be a financial expert?

Any individual who offers investment guidance which most economic advisors do must be registered as an investment expert with the SEC or the state if they have a certain quantity of properties under management. Why is "expert" occasionally spelled "advisor"? Exists a difference? While the two terms are typically utilized mutually, "advisor" is the legal term used in the united state

The 25-Second Trick For Final Expense In Toccoa Ga

Some companies like the Structure for Financial Preparation offer totally free aid to individuals in need, including veterans and cancer cells clients. And while you shouldn't believe whatever you check out on the net, there are lots of credible resources for financial information online, including government resources like Investor. gov and the Financial Sector Regulatory Authority - https://www.nulled.to/user/5926895-jstinsurance1.

If you are trying to pick a financial advisor, understand that any individual can legitimately utilize that term. Always request (and validate) an expert's specific qualifications. Any person who gives which most financial advisors do must be signed up as an investment expert with the SEC or the state if they have a specific amount of assets under monitoring.

Lead ETF Shares are not redeemable directly with the issuing fund aside from in very large aggregations worth countless dollars. ETFs undergo market volatility. When getting or offering an ETF, you will pay or receive the current market price, which might be basically than net asset value.

Our Health Insurance In Toccoa Ga PDFs

The majority of financial consultants function regular full-time hours throughout the work week. Several advisors are employed by firms, however about 19% of monetary advisors are self-employed, according to data from the Bureau of Labor Data. In regards to qualifications, economic experts usually have at the very least a bachelor's degree in an associated subject like service, financing or mathematics.

Nevertheless, there are some crucial distinctions between a monetary advisor and an accounting professional that you must understand. Accountants are a lot more focused on tax obligation planning and prep work, while monetary advisors take an all natural consider a customer's financial circumstance and help them prepare for lasting monetary objectives such as retirement - Home Owners Insurance in Toccoa, GA. Simply put, accounting professionals handle the previous and existing of a client's financial resources, and economic experts are concentrated on the customer's economic future

The Definitive Guide to Life Insurance In Toccoa Ga

Accountants have a tendency to be hired on a temporary basis and can be considered service providers, whereas monetary experts are more probable to establish a lasting expert connection with their clients. Finally, accountants and monetary consultants differ in their approach to financial subjects. Accounting professionals often tend to focus on a specific location, while monetary experts are frequently generalists when it concerns their economic experience.